Here’s some sad news: The State of Arkansas could get more money for college scholarships by raising the state sales tax four-tenths of a penny than it currently “generates” with the Arkansas Lottery.

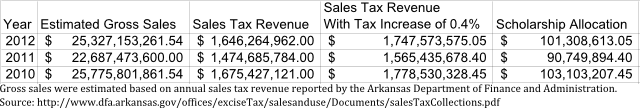

According to reports on the Department of Finance and Administration’s website, the State of Arkansas has collected roughly $1.4 – 1.6 billion annually in sales taxes since 2010. The state sales tax is currently 6.5% — meaning for every dollar you spend at the store, the state charges six-and-a-half cents in sales tax.

In order to collect an additional $90 – $100 million — the amount of money lottery proponents promised Arkansas’ college students would receive — the State of Arkansas would need to charge a “whopping” four-tenths of a penny extra on each sales dollar, raising the tax rate from 6.5% to 6.9%.

In order to collect an additional $90 – $100 million — the amount of money lottery proponents promised Arkansas’ college students would receive — the State of Arkansas would need to charge a “whopping” four-tenths of a penny extra on each sales dollar, raising the tax rate from 6.5% to 6.9%.

Now, I am not advocating higher taxes. I think we are taxed enough as it is. But in 2009, if lawmakers had said, “We have to come up with an extra $100 million in college scholarships, and we can do it either by raising the state sales tax or by instituting a state-run lottery,” I would have told our lawmakers, “Raise the sales tax.”

Here are five reasons why:

- A state sales tax increase would pull an extra $100 million out of Arkansas’ economy. That’s bad, but you know what’s worse? Pulling $400 – $500 million out of the economy. That’s how much the Arkansas Lottery tries to drain each year. A little bit of that money goes to the gas stations that sell the lottery tickets or the students applying for scholarships; most of it pays the lottery’s staff, vendors in other states, or covers a host of other expenses. The money leaves the local community, and it doesn’t return.

- A state sales tax doesn’t require any extra bureaucracy. The Arkansas Legislature had to establish an entire commission and state agency to run the lottery — an agency complete with employees earning six-figure salaries and complicated contracts with lottery vendors based outside Arkansas. A sales tax isn’t great, but at least you don’t have to set up a brand new commission to oversee it.

- A sales tax doesn’t attract outside interests or create room for corruption. As soon as Arkansas legalized a state-run lottery, lottery corporations from all over the globe were at the door, ready to fleece people out of their hard-earned money. The Arkansas Lottery was an opportunity for market expansion in the gambling world. Any effort to rein in the lottery almost inevitably runs afoul of those special interests. Whatever issues you may have with sales taxes, they rarely result in questionable contracts or attract much attention beyond the state’s retailers.

- No one ever got addicted to a sales tax. Sure, there are compulsive shoppers, and there are people who spend beyond their means. But a sales tax doesn’t encourage that kind of behavior. Gambling is both addictive and destructive. People get addicted to the games, and they end up ruining their lives — and oftentimes the lives of their children or other family members — as a result. If lives are ruined, the State of Arkansas shouldn’t be contributing to the problem.

- The sales tax would actually result in more money for scholarships than Arkansas’ lottery has. As I said, the tax increase would result in $90 – $100 million in scholarship revenue each year. Lottery proponents promised voters $100 million a year in scholarship money back in 2008. That promise has never been met — not once. In fact, even when the Arkansas Lottery lowered its scholarship goals, it still struggled. Sales tax revenue might rise and fall with the economy, but it would be more reliable than the lottery has proven to be.

Conclusion

Again, I’m not advocating new taxes. All I’m trying to do is illustrate how pitiful Arkansas’ lottery is at “generating” scholarship revenue. Even if the Arkansas Lottery lived up to all its promises, the cost to the people of Arkansas would be astronomical.

There are plenty of ways to send students to college. But if you listed those ways from best to worst, raising taxes would beat a state-run lottery.

When a sales tax increase is clearly better than what you’re doing right now, you know something isn’t right.